how to declare mileage on taxes

Deduct your employers mileage limit if applicable. Alternatively if you do not file a self.

How To Deduct Mileage If You Are Self Employed 2022 Turbotax Canada Tips

Enter odometer readings from the start and finish of your journey.

. Determine Your Method of Calculation. Standard IRS Mileage Deduction. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year.

If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage. This is the easiest method and can result in a higher deduction. You must report and pay tax through a PAYE Settlement Agreement as a COVID-19 related benefit.

If youre self-employed or an independent contractor however you can deduct mileage. The IRS Standard Mileage rate is the standard mileage reimbursement rate set by the IRS each year so that employees contractors and employers. And Canada Dashers- To keep track of your total mileage and maximize your business-related deductions on your 2022 tax return we recommend using mileage tracking.

How to Claim Mileage on Your Taxes If youre claiming a deduction for business mileage youll report it using Schedule C on Form 1040. On your self-assessment tax return. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return.

There are two ways to calculate mileage reimbursement. To claim mileage deductions for. For example in 2019 you could claim 58.

Youll need two figures. How to Log Mileage for Taxes in 8 Easy Steps 1. Total kilometres you drove during the year Total.

That means the mileage tax deduction 2021 rate is different from previous years. The best way to Create a Mileage Expense Sheet in Excel Begin Excel and choose the File tab. IRS STANDARD MILEAGE RATE.

The standard mileage deduction. How to I deduct doordash mileage from my earnings to pay Q3 taxes. September 4 2020 1055 PM.

To use this method multiply your total business miles by the IRS Standard Mileage Rate for. Work out the value To calculate the approved amount multiply your employees. For amounts less than 2500 file your claim.

Do I subtract Mileage 575 cents and then take 22 of the remaining. It includes factors like gasoline prices wear-and-tear and more. The best way to track your business miles is to write down your mileage at the beginning of the day and the end of the day.

Your mileage deduction isnt hard to calculate if youve kept accurate records in your logbook. You can deduct any miles that add to the. For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000.

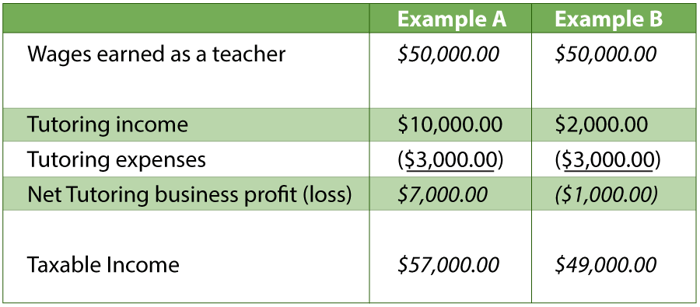

The standard mileage rate lets you deduct a per-cent rate for your mileage. Make Sure You Qualify for Mileage Deduction. Report your total gross income on Schedule C then reduce it to net income by subtracting the amounts you spent for allowable business-related expenses.

Medical Claim Form Template Beautiful Exceptional Medical Expense Claim Request Form Examp Form Example Reference Letter Template Professional Reference Letter

What Are The Mileage Deduction Rules H R Block

Employee Deduction For Commuting Tax Deductions Canada

Are Medical Expenses Tax Deductible

How To Make The Most Of Work Vehicle Expenses On Your Tax Return Cbc News

Ecommerce Tax Deductions A Complete List For Online Sellers Bench Accounting

Tracking Your Taxes For Direct Sales Consultants Direct Sales Consultant Direct Sales Thirty One Business

Free Sample Vehicle Delivery Note Template Google Docs Word Apple Pages Pdf Template Net Notes Template Templates Words

Tax Deductions For Small Businesses In Canada Srj Chartered Accountants Professional Corporation

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

7 Insanely Awesome Write Offs That Solopreneurs Need To Know Business Tax Tax Write Offs Small Business Organization

10 Key Tax Deductions For The Self Employed

How To Report Inventory At Income Tax Time When You Are A Home Party Sales Rep Homepartyrep Directsa Pure Romance Consultant Pure Romance Party Pure Romance

What Receipts Should I Keep For My Taxes Loans Canada

What Can Independent Contractors Deduct

Simplify Your Tax Records With These Tips Tax Simplify Online Business Marketing

What Are Some Self Employed Tax Deductions In Canada

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

How To Declare Taxes As An Independent Consultant Sapling Lularoe Business Jamberry Business Thirty One Business