modified business tax id nevada

What is the Modified Business Tax. Enter your Nevada Tax Pre-Authorization Code.

State Of Nevada Department Of Taxation Ppt Video Online Download

There are no changes to the Commerce Tax credit.

. You can easily acquire your Nevada Tax ID online using the NevadaTax website. Federal Tax ID EIN Number Obtainment. Register File and Pay Online with Nevada Tax.

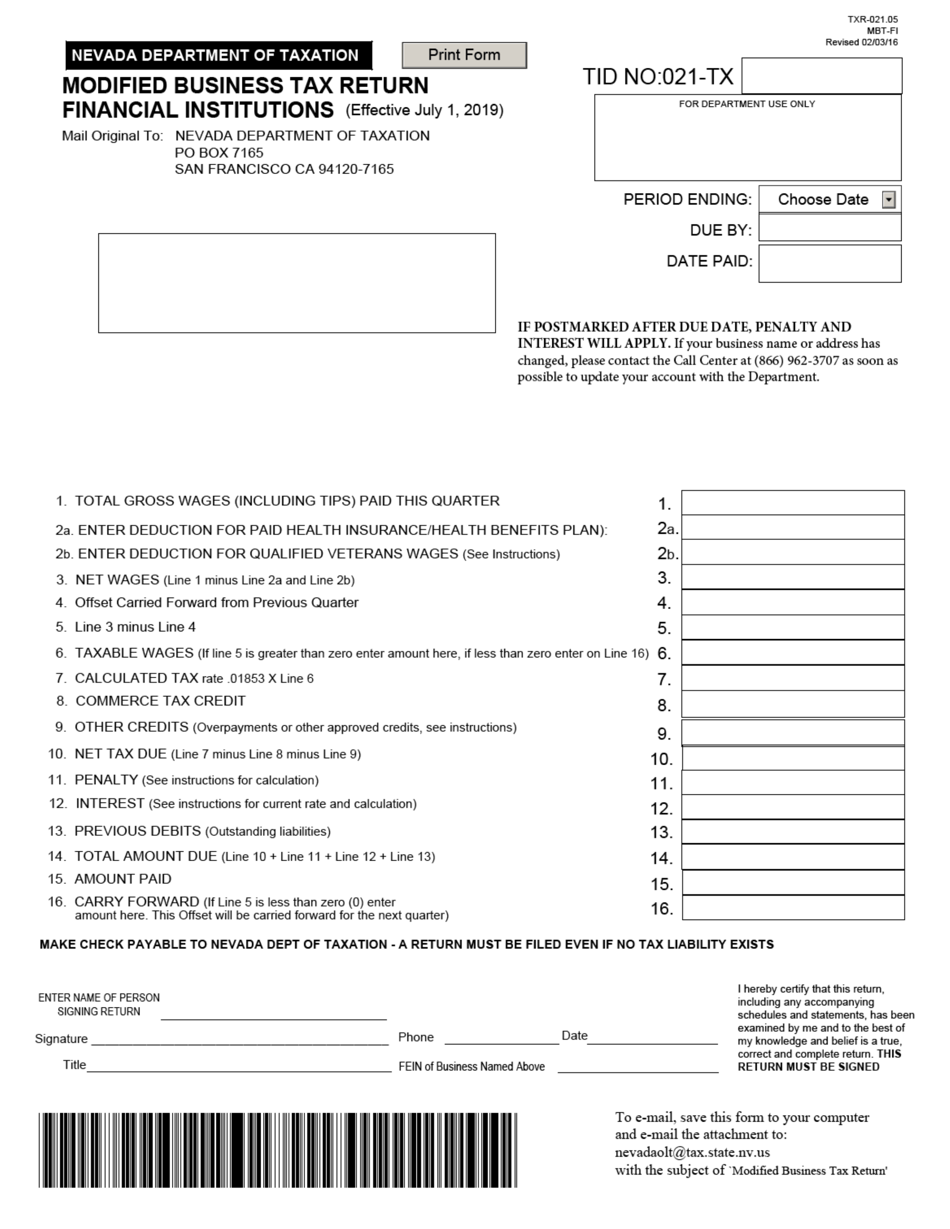

Search by Business Name. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as defined by NRS 360A050. This bill mandates all business entities to file a Commerce Tax return.

Otherwise no MBT will be due. Failure to remit Nevada Use Tax Modified Business Tax Tire Fees Live Entertainment Tax Liquor or Tobacco Taxes. Vehicle RV aircraft or vessel tax evasion.

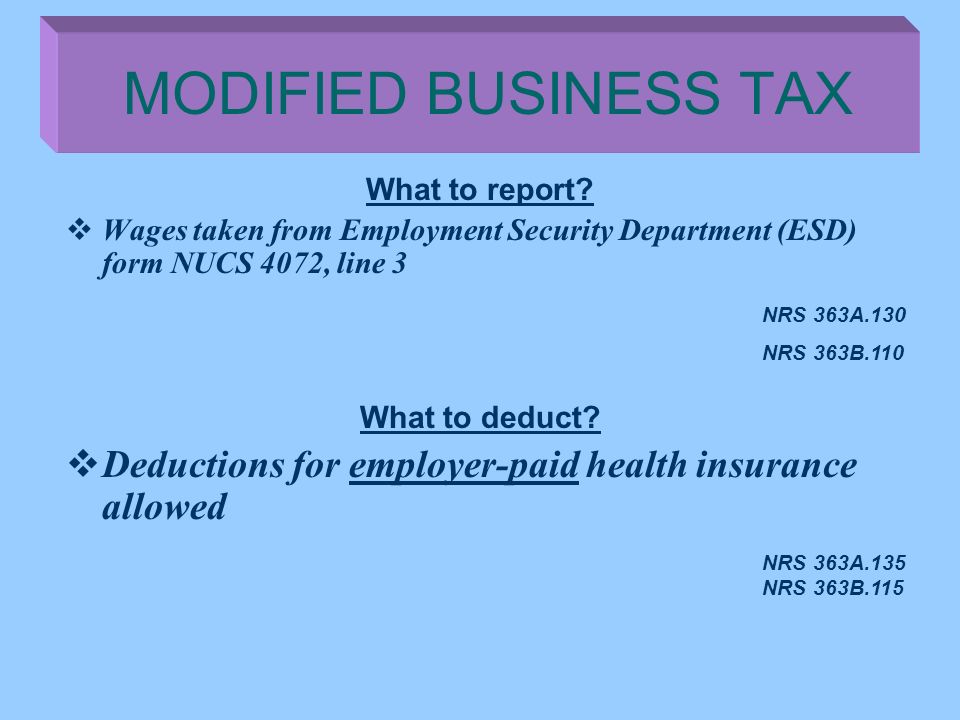

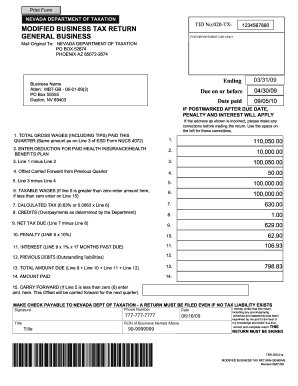

If your business has taxable wages that exceed 62500 in a quarter then the MBT is applied. NV Taxation - Permit Search. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter. 5 Federal Tax Identification Number 6 CorporateEntity Address. If you need help with the Nevada Modified Business Tax Form or the Nevada Modified Business Return AMS Payroll 134 is the best product to try.

Nevada Business ID NVB ID. Tax Identification Number TID. These numbers are required for us to make state tax payments and filings on your behalf.

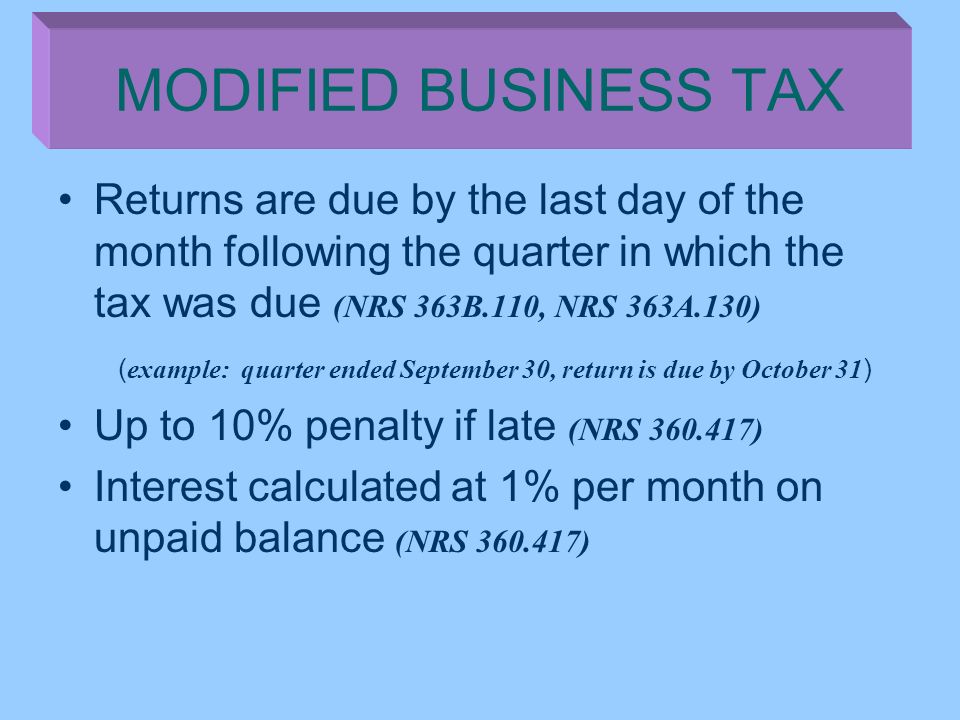

NV DETR Modified Business Tax Account Number. Tax is based on gross wages paid by the employer during a calendar quarter. 2020 modified business tax nevada form Local lawmakers choose modified enterprise tax to enterprise license charge Pete Goicoechea R-Eureka voiced help for an Assembly Republican plan to up the modified enterprise tax fee of common companies and mines from M17 to Mfifty six and decrease the speed on monetary sector companies.

The Department is now accepting credit card payments in Nevada Tax OLT. Operating without a Sales Tax Permit. Effective July 1 2019 the tax rate changes to 1853 from 20.

Nevada Modified Business Tax Rate. This number should be used to address questions regarding sales use tax modified business tax general tax questions or information regarding establishing a new account. TID Taxpayer ID Search.

The current MBT rate is 117 percent. Click here to schedule an appointment. Enter your official contact and identification details.

To avoid duplicate registrations of businesses you are required to update your account with your Nevada Business ID example. Ask the Advisor Workshops. Business Telephone Fax 8 E-mail Address.

GovDocFilings easy to complete application form makes the. Double check all the fillable fields to ensure full accuracy. Exceptions to this are employers of exempt organizations and employers with household employees only.

Nevada Modified Business Tax General BusinessFinancial Institution. Failure to collect or remit Sales Tax. Dont Have a Nevada Account Number andor an MBT Account Number.

Employers may deduct allowable health care expenses from the taxable wage amount. Nevada modified business tax covers total gross wages amount of all wages plus any tips for each calendar quarter minus employee health care benefits paid by the business. 9 Nevada Business Identification.

Get Your Nevada Tax ID Online. Whether youve formed a corporation created a partnership established a trust or simply opened a new small business you will need a Nevada Tax ID number. NV20151234567 obtained from the Nevada Secretary of State.

If you have an existing business registered with the Department of Taxation you will need to enter your Business Name and 10-digit Tax ID number. Street Number Direction N S E W and Name Suite Unit or Apt City State and Zip Code 4 State of Incorporation or Formation 7 Nevada Name DBA. Top Apply For Your Nevada Tax ID Now.

866 962-3707 Carson City Department of Taxation 1550 College Parkway Suite 115 Carson City Nevada 89706 775 684-2000 voice 775 684-2020 fax Reno Department of. General Business General business is considered as any employer who will be required to pay a contribution to the Department of Employee Training and RehabilitationEmployment Security Division pursuant to NRS 612535 in any calendar quarter. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter.

An Easy to Use Business Solution. Nevada Department of Employment Training Rehabilitation Unemployment tax. Messy andor incomplete data is the greatest problem facing most business owners and accountants during this process.

Applying for a Nevada Tax ID is free and you will receive your permit immediately after filing your application. However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter. Modified Business Tax is a self-reporting tax and you are responsible for properly characterizing your business as a Financial Institution or General Business.

Our payroll software makes data generation storage and application easy. Search by Permit Number TID Search by Address. 99-9 9 digits Find a current MBT Account Number.

The Tax IDentification number TID is the permit number issued by the Department. The New Business Checklist can provide you a quick summary of which licenses youll need estimated cost and time to obtain licensing. In Nevada there is no state-level corporate income tax.

Follow the on screen instructions to Verify Your Business using the Nevada Tax Access Code found on the Welcome to. Registering to file and pay online is simple if you have your current 10 digit taxpayers identification number TID a recent payment amount and general. Click Here for details.

MBT or Modified Business Tax is a type of Nevada commerce tax that is applicable to two types of categories and they are. File for Nevada EIN. In the New Nevada Employer Welcome package sent by NV after a company registers with the DETR.

Clark County Tax Rate Increase - Effective January 1 2020. If your taxable wages fall under 62500 then you do not pay the MBT. Wages are as defined in NRS 612190.

You must provide a valid Nevada Account Number and Modified Business Tax MBT Account Number to sign up for Square Payroll. To get your Nevada Account Number and MBT Account Number register. Use a check mark to point the answer where needed.

Use the Sign Tool to create and add your electronic signature to signNow the Nevada modified business tax return form. However the Department will classify taxpayers when it discovers through account review audit a lead or other research that a company falls into one of the definitions under NRS 363A050. The majority of Nevada businesses will need to get a federal tax ID number.

State Of Nevada Department Of Taxation Ppt Video Online Download

Obtain A Tax Id Ein Number And Register Your Business In Nevada Business Help Center

State Of Nevada Department Of Taxation Ppt Video Online Download

Incorporate In Nevada Do Business The Right Way

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions 2016 Templateroller

State Of Nevada Department Of Taxation Ppt Video Online Download

Blayne Osborn Blayneosborn Twitter

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller