njtaxation.org property tax relief homestead benefit

Multiplying the amount of your 2017 property taxes paid up to 10000 by 10. New Jersey homeowners will not receive Homestead property tax credits on their Nov.

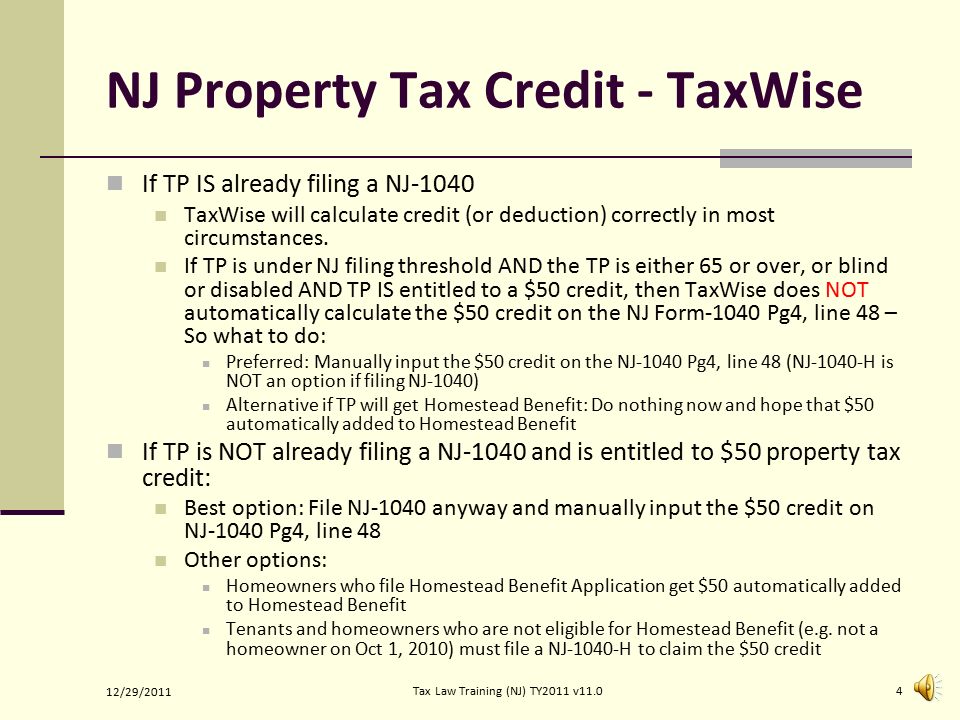

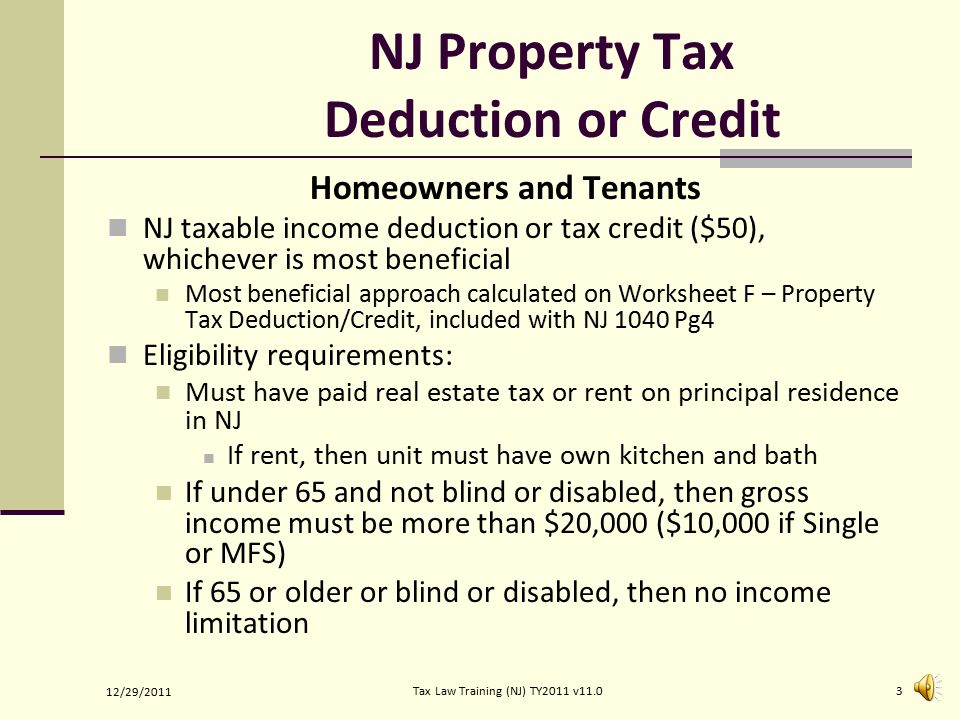

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Now the average Homestead Benefit is about 490 and it is calculated based on the 2006 tax year according to the state tax data.

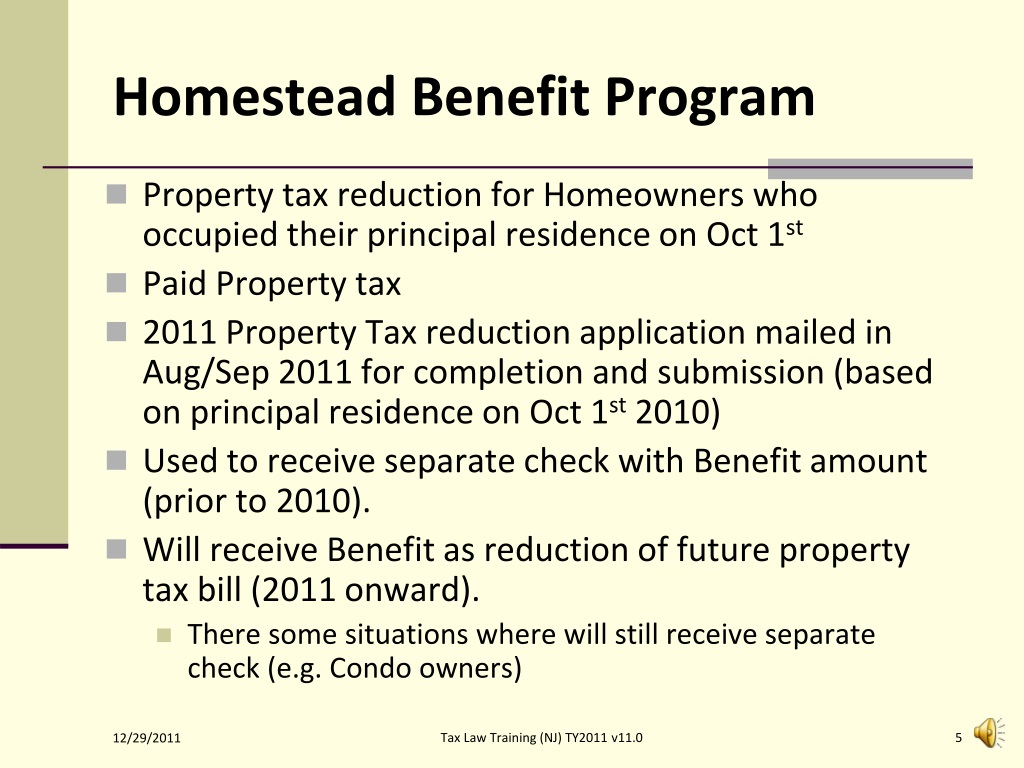

. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and then cut the program by 142 million. Eligibility requirements including income limits and benefits available under this program are subject to. You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018.

The automated telephone filing system and this website will be. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022. Moreover the average property-tax bill has increased by more than 40 since 2006 according to the states most recent tax data.

The system will also indicate whether the benefit was applied to your property tax bill or issued as a check or direct deposit to your. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax. Those making over 100000 up to 150000 could get a 25 credit.

You can change all preprinted information with the exception of Name and Property Location when you file online or over the phone. And over the past five years the average New Jersey property-tax bill has increased by 563 easily swamping todays average Homestead benefits which are 526 for senior and disabled recipients and 412 for. The document you are trying to load requires Adobe Reader 8 or higher.

The NJ Division of Taxation mailed New Jersey homeowners filing information for the 2018 Homestead Benefit in October. The program was restored in the approved budget that went into effect on October 1 2020. You were a New Jersey resident.

Over 100000 But not over 150000. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. Preprinted Identification Number and PIN.

The program rules and online application are found at njgovtaxation click on Property Tax Relief Programs. Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. Most recipients get a credit on their tax bills.

1-877-658-2972 toll-free within NJ NY PA DE and MD 2018 benefit only. Check or Direct Deposit. Just how much property tax relief would people see.

The main reasons behind the steep rates are high property values and education costs. And seniors or disabled people werent eligible for any credit if they made more than 150000. 75000 for homeowners under 65 and not blind or disabled.

You can file for a Homestead Benefit regardless of your income but if it is more than the amounts above we will deny your application. Funding for the property tax relief program. Follow the instructions You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018.

And The 2018 property taxes were paid on that home. The 2021 property tax credits are based on ones 2017 income and property taxes paid. The Homestead Benefit program provides property tax relief to eligible homeowners.

You can get information on the status amount of your Homestead Benefit either online or by phone. Online Inquiry For Benefit Years. Pass-Through Business Alternative Income Tax PTEBAIT Sales and Use Tax.

You may not have the Adobe Reader installed or your viewing environment may not be properly. To file an application by phone1-877-658-2972. Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ tax returns.

Property Tax Relief Programs. Make sure to save it. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline.

Search here for information on the status of your homeowner benefit. The NJ Homestead Benefit reduces the taxes that you are billed. File for the property shown with your Identification Number.

We do not send Homestead Benefit filing information to homeowners whose New Jersey Gross Income for the application year was more than the income limits established by the State Budget. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. Homestead Benefit and Senior Freeze Property Tax Reimbursement payments are not taxable for New Jersey Income Tax purposes and should not be reported on the New Jersey Income Tax return.

Information on the federal tax treatment of these payments called recoveries by the IRS can be found in the federal Form 1040 instructions and IRS. Eligible seniors or disabled people with New Jersey gross income of up to 100000 would get a credit worth 5 of their 2006 property taxes. You are eligible for a 2018 Homestead Benefit as a home-owner if.

Multiplying the amount of your 2017 property taxes paid up to 10000 by 5. Credit on Property Tax Bill. 1 real estate tax bills a state treasury official said Wednesday.

Homestead Benefit Online Filing. Your benefit payment according to the FY2022 Budget appropriation is calculated by. Your tax collector issues you a property tax bill or advice copy reflecting the amount of your benefit.

2016 2017 2018 Phone Inquiry. Tenants The amount appropriated for property tax relief programs in the State Budget does not include funding for 2018 tenant rebates. Use the instructions below to help you file your Homestead Benefit application over the telephone or online.

To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019. Income Tax Residents Only Partnerships. Have a copy of your application available when you call.

If a benefit has been issued the system will tell you the amount of the benefit and the date it was issued. And erty should file the application. 1-877-658-2972 When you complete your application you will receive a confirmation number.

File Online or by Phone. 9-1-1 System and Emergency Response Fee. The benefit amount has not yet been determined.

When you report your property taxes paid you already account for this benefit.

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Nj Property Tax Relief Program Updates Access Wealth

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Memoli Company Pc Home Facebook

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Property Tax Relief Programs West Amwell Nj

Property Tax Relief Programs West Amwell Nj

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj 2 Property Tax Relief Programs Ppt Download

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 1525957